However if you opt for the new tax rates you will not be eligible to claim any tax deductions under Section 80C. Exempt to the extent of expenditure incurred.

Post Budget Tax Math Should You Shift From Epf To Nps Now Mint

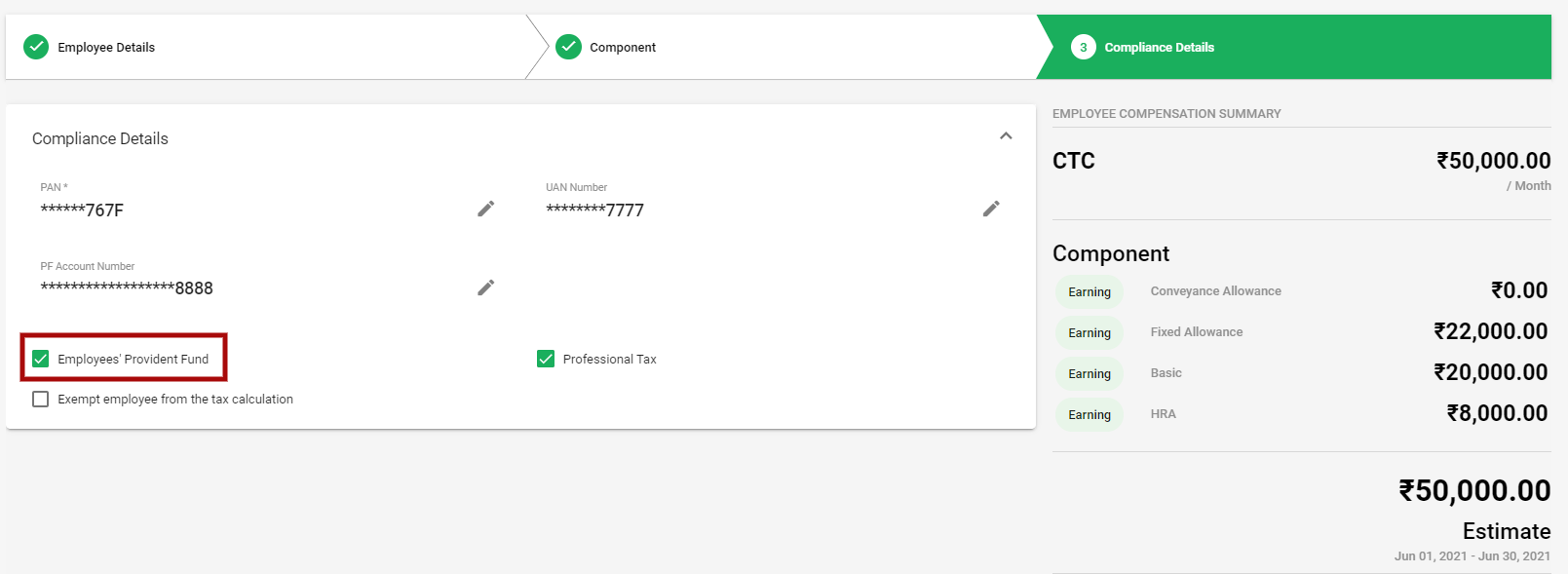

The appellant company was not deducting Provident Fund contribution on house rent allowance special allowance management allowance and conveyance allowance by excluding it from basic wage.

. The authority under the Act held that the special allowances formed part of basic wage and was liable to deduction. All cash payments by whatever name called paid to an employee on account of a rise in the cost of living house-rent allowance overtime allowance bonus commission or any other similar allowance payable to. 107 Foreign allowances or perquisites paid or allowed by Government to its employees an Indian citizen posted outside India.

Payments which are not liable for EPF contribution are- Service charge Overtime payment Gratuity Retirement benefit Retrenchment lay-off or termination benefits Any travelling allowance or the value of any travelling concession Any other remuneration or payment as may be exempted by the Minister Gifts. Dividend rates for Simpanan Shariah will be based on actual performance of the EPFs shariah compliant investments. Civil Appeal Nos.

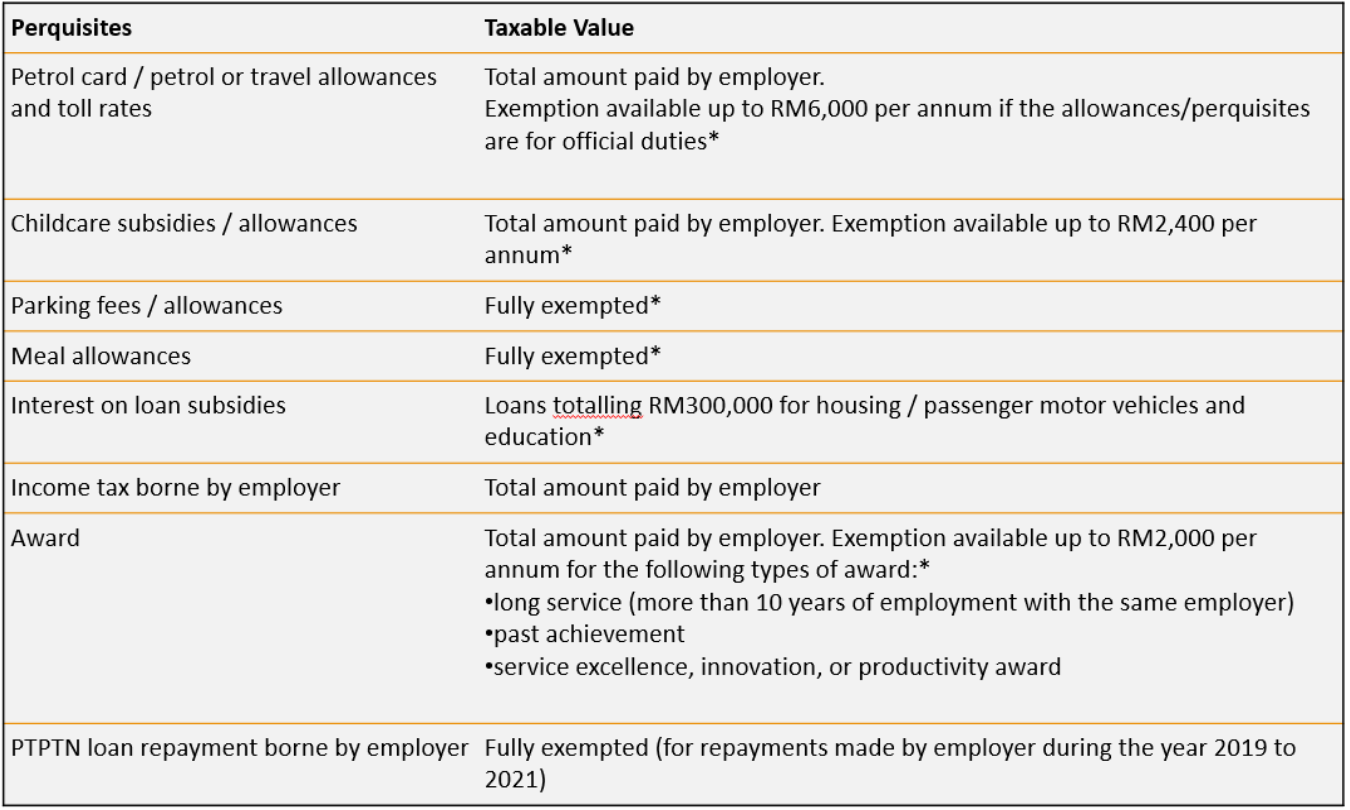

If the amount received exceeds RM6000 a year the employee can make a further deduction in respect of the amount spent for official duties. Petrol allowance travelling allowance or toll payment or any of its combination for official duties. Tax exemption on EPF Withdrawal For the below cases there is no TDS Tax deduction at source.

Section 43 1 EPF Act 1991 Determining Obligation To Contribute These are the three main elements which determine the obligation to contribute to EPF. Tax exemption on EPF Withdrawal. Not all allowances exempt from PF.

However in another income tax rule change proposed in Budget 2020 the employers. Employer Employee Contract of Service or Apprenticeship Wages You need to register with the EPF if you fulfill the following elements. Payment from recognized provident fund shall be exempt in the hands of employees in following circumstances.

EPFO However circular does not clarify which these allowances are The flexibility exercised by employers and the provident fund authorities in the definition of basic wages has finally caught the attention of the Employees Provident Fund Organisation EPFO. Employer Employee Contract Of Service Or Apprenticeship. The Apex Courts ruling will warrant increased PF contributions by employers for employees whose basic wages are lower than Rs 15000 per month.

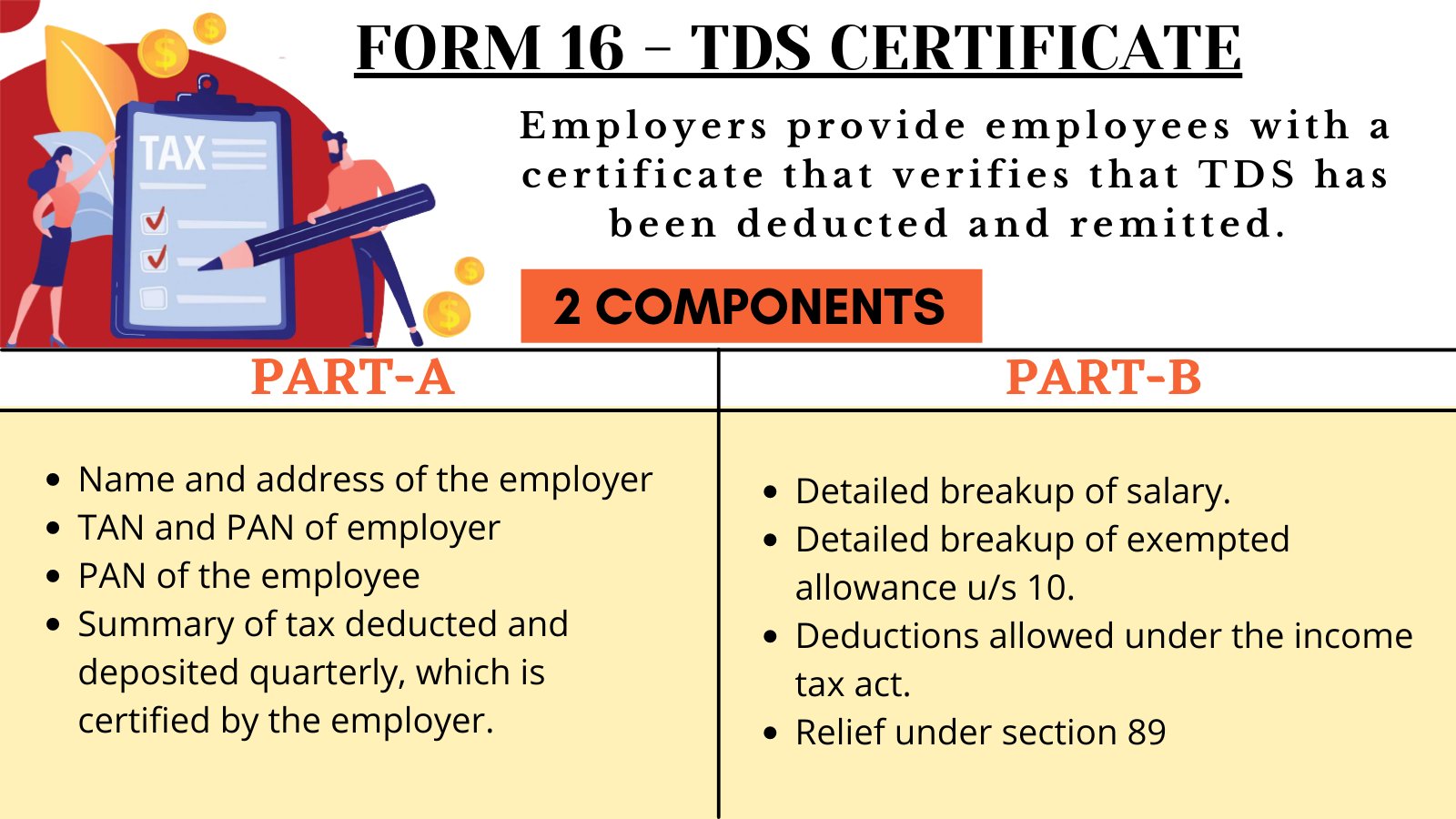

However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference. Salary Segments That Can Reduce Employees Tax Liabilities Sag Infotech Salary Segmentation Tuition Fees The Employees Provident Funds and Miscellaneous Provisions Act 1952 EPF Act defines basic wages to include any other allowance similar to dearness allowance house rent allowance etc payable. Tax exemption on EPF Withdrawal For the below cases there is no TDS Tax deduction at source.

Any contribution towards EPF of up to 12 is eligible for deduction under Section 80C of Income Tax. Allowance Allowance except travelling allowance is included in the definition of wages under the EPF Act. Service charges tips etc Overtime payments Gratuity payment to employee payable at the end of a service period or upon voluntary resignation Retirement benefits Termination benefits Travel allowances.

1If an employee completes 5 years of Service then there is no TDS for withdrawal from EPF. As per the EPFO Act PF does not cover certain specified exclusions like cash value of any food concession. Further foreign nationals who are required to be.

2If an employee withdraws less than Rs50000 before 5 years of service then there is no TDS on Withdrawal. EXEMPTION LIMIT PER YEAR 1. 2019 Deloitte Touche Tohmatsu India LLP Provident Fund applicability on allowances 7 The PF authorities issued a circular in November 2012 which inter alia indicated that the term any other allowance of a similar nature which is to be excluded for PF.

Payments Subject to EPF Contribution In general all monetary payments that are meant to be wages are subject to EPF contribution. Our Past Dividend Rates. This will continue under the old tax rate.

Salaries Payments for unutilised annual or medical leave Bonuses Commissions Incentives Arrears of wages Wages for maternity leave. Any Allowance given for meeting Business Expenditure Section 1014 Interest Incomes Section 1015. Which payments are subject to EPF contribution and which are exempted.

A If employee has rendered continue. Any other remuneration or payment as may be exempted by the Minister Dividend Rates For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. Payments Exempted From EPF Contribution The payments below are not considered wages by the EPF and are not subject to EPF deduction.

The accumulated balance due and becoming payable to an employee participating in a recognised provident fund is exempt to the extent provided in rule 8 of part A of the Fourth Schedule. 2019 Deloitte Touche Tohmatsu India LLP Provident Fund applicability on allowances 7 The PF authorities issued a circular in November 2012 which inter alia indicated that the term any other allowance of a similar nature which is to be excluded for PF computation refers only to an.

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Understand Salary Breakup In India Importance Structure And Calculation Asanify

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

How To Add Conveyance Allowance As A Deduction In Itr 1 While E Filing Quora

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Exempted Allowances To Salaried Persons Simple Tax India

Everything You Need To Know About Running Payroll In Malaysia

What Is Conveyance Allowance Meaning Limit Exemption And Calculation

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

Special Allowances In India Under Income Tax Return Itr Taxhelpdesk

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Pf Provident Fund On Special Allowances As Per Supreme Court Youtube

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Can An Employee S Contribution Be Withdrawn From A Pf In The Case Of Illness Quora

Employee Provident Fund A Complete Guide

How To Add Conveyance Allowance As A Deduction In Itr 1 While E Filing Quora

Online Compliances Ocompliances Twitter

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Know Salary Segments That Can Reduce Employees Tax Liabilities