Hence there is a whole. Employers and employees will contribute 02 each of an employees salary this means that the total contribution would be 04 of an employees monthly salary.

Calculation Example normal working days.

. On the other hand the maximum eligible monthly salary contribution is capped at RM4000. There are virtually millions of. Employee medical insurance management Price and benefits negotiation Quotes New enroll deletion amendments claims etc including market comparison.

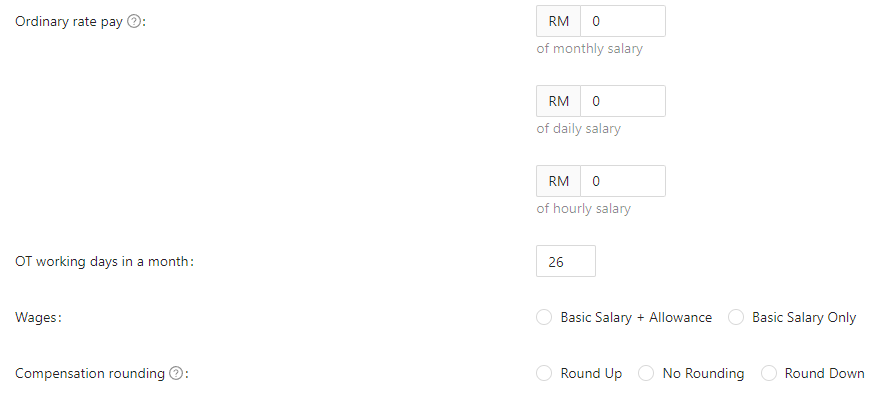

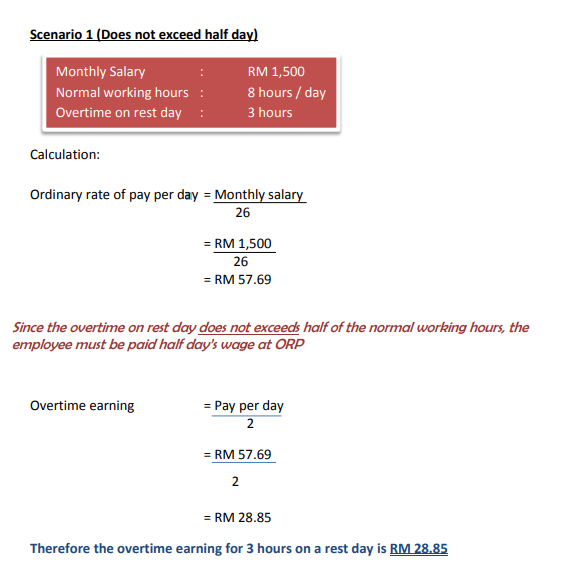

For employees who get paid on a monthly basis the hourly rate could be obtained by dividing the monthly salary by 25 or 26 days then divided by the amount of hours per normal working day. Or in other words it can be termed as a person who is hired for a wage or salary to work for an employer. Use this number to calculate how much the employee is paid daily monthly salaryworking days in a month.

The Occupational Safety Health and Working Conditions Code 2020. Foreign workers should therefore know their rights and benefits provided under the law. The calculation is based on the existing laws prior to 2008.

Migrant workers who work outside their home country are also called foreign workersThey may also be called expatriates or guest workers especially when they have been sent for or invited to work in the host country before leaving the home country. For a period of 90 days to be increased to 85 for the following 90 days. Fully Solved Papers 2010 - ID5c1289cc9b92f.

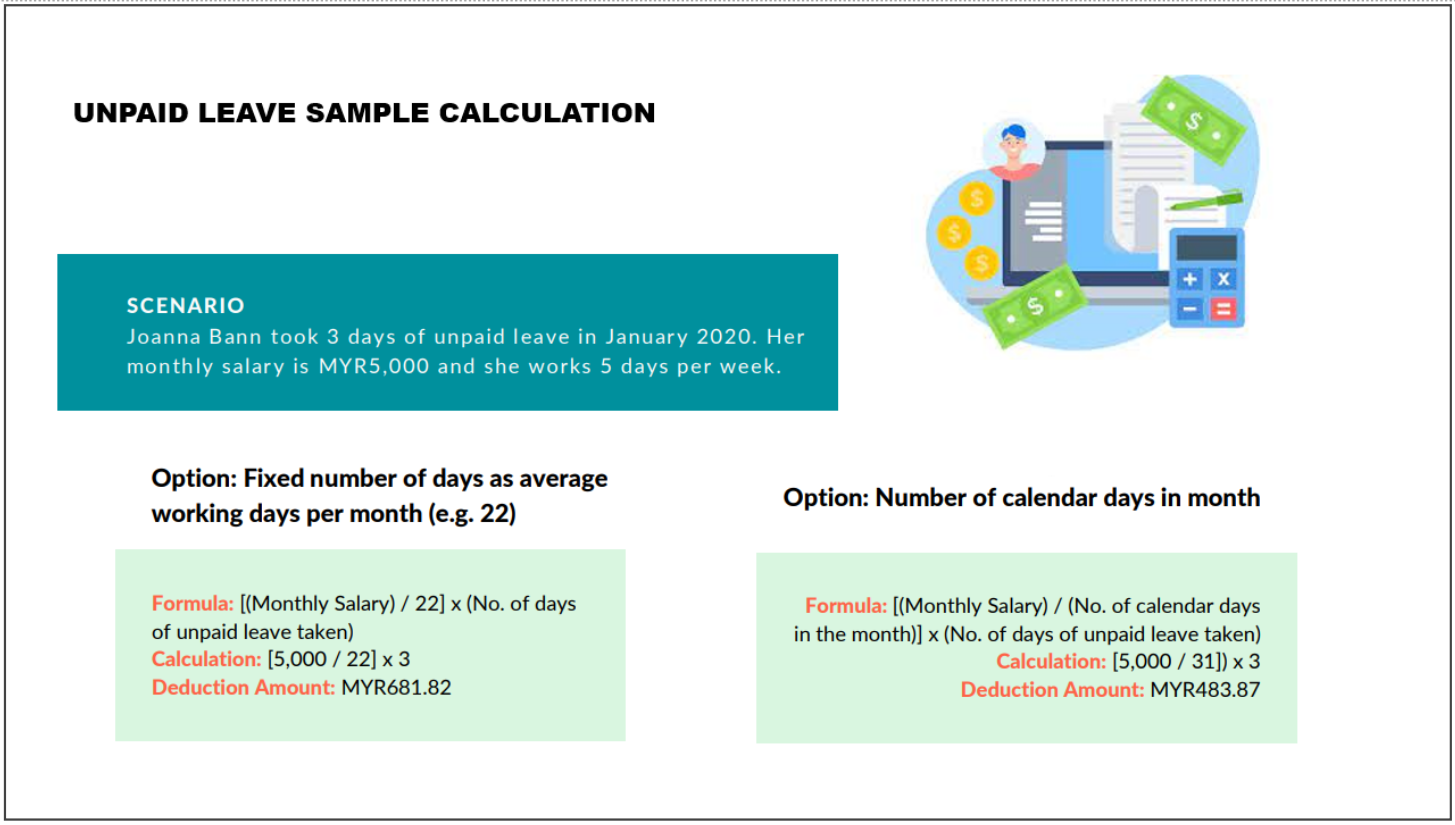

Ali earned RM 2000 a month and took 4 days of unpaid leave in September 2020. Overtime 4 hours. The Code on Wages 2019.

A 13th salary may apply depending on the Joint Labour Committee. For part-time employees the hourly rate was increased by one yuan per hour ie from 20 to 21 yuan per hour. Shall be deemed to be salary or wages income taxable at the rate declared by Section 12 of the Income Tax Salary or Wages Tax Rates Act 1979.

According to the section-10 of Payment of Bonus Act 1965 it is an employee right drawing salary of Rs. Short title and application 1 This Act may be cited as the Employment Act 1955. The work wages is 100 the overtime wages is 150 and the different overtime wages is 200.

To claim for payment of minimum bonus that is 833 of his salary his her salary will be treated as maximum Rs. Input your basic monthly salary as stated in your contract. In each day type.

151 The University and staff may enter into PBCs with a threshold annual salary and loadings including the cash value of any University-provided motor vehicle and employer superannuation contributions of at least 227173 at Level E or above or 156026 at HEW 10 or aboveThese threshold salary levels will be indexed in line with the. Labour is at the end of this road it must reclaim social material justice as its central task or go to the wall. An employee with proven record of sickness is entitled to a paid sick leave at the rate of 75 of hisher salary upon which social insurance payments are calculated.

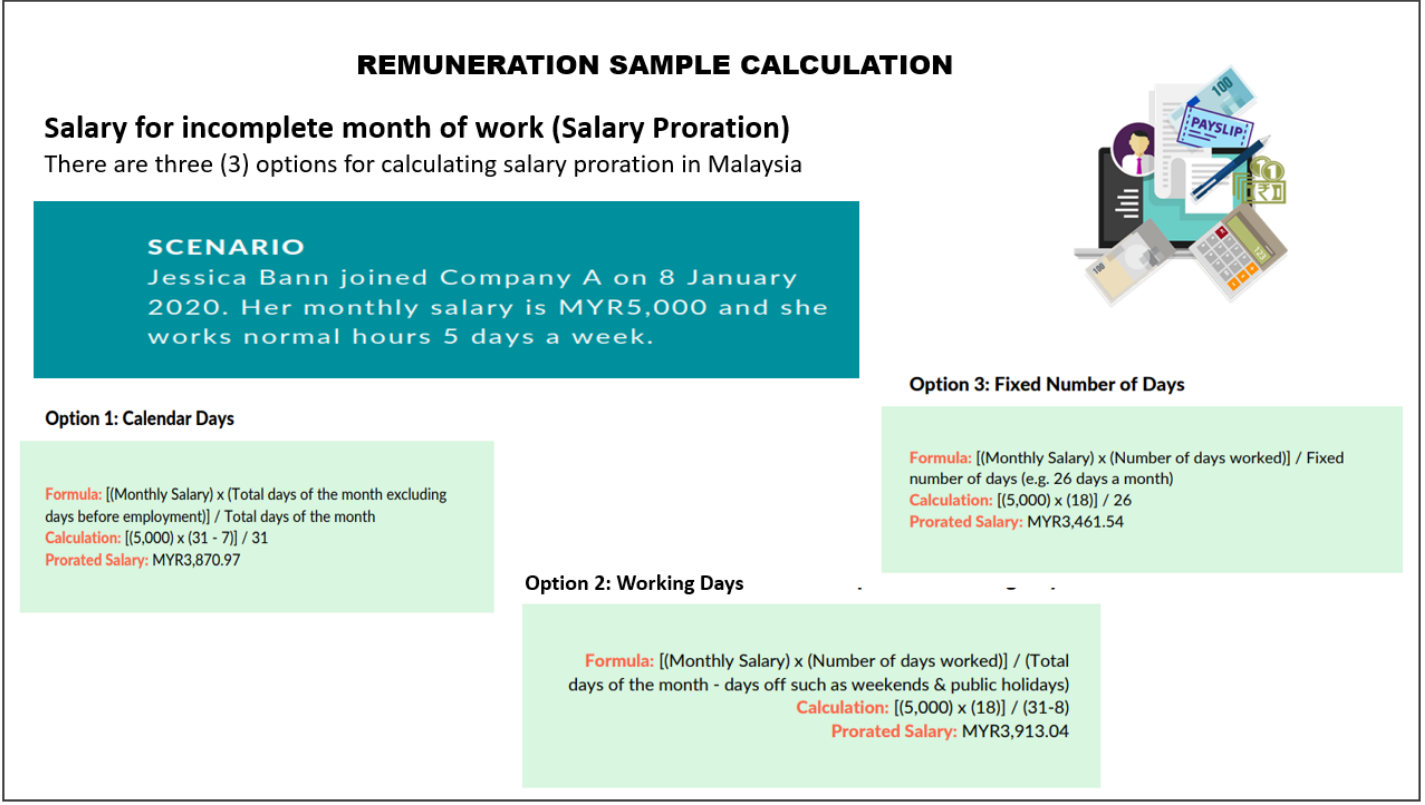

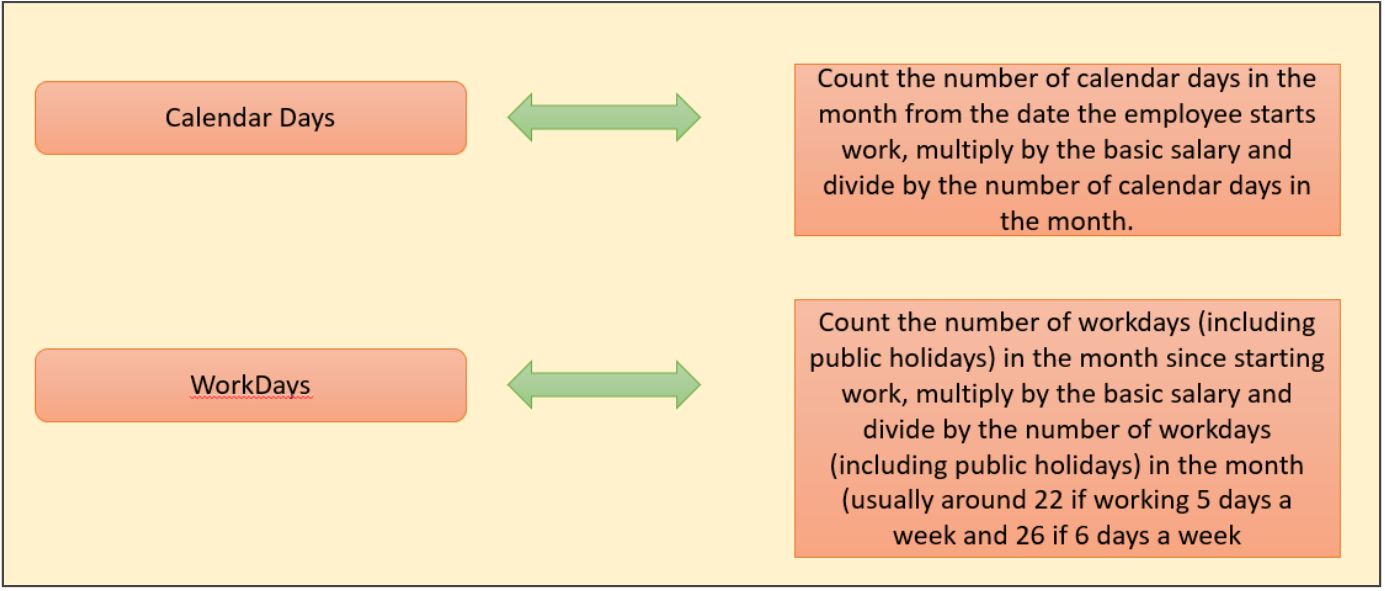

Note on wages calculation. Employees whose service was after 1 January 2008 a. Salary calculation also differs based on the labor law of a country.

The gross monthly salary is determined by the average of the last 12 salaries before the employee takes the leave. Input the number of payable days per year minimum of three weeks or 21 days as per the law. To amend and consolidate a majority of Indian labour laws the following four labour codes have been passed by the Parliament of India which subsumes and amalgamates 29 different central labour laws legislations.

Annual salary surveys via Market research benchmark Review verify and approve WPS the monthly Payroll and other supporting reports. Labour law is the area of law which signifies the relationship between a worker trade union and government at large. Manual calculation of unpaid leave.

There are a number of protections provided by the government for the foreign workers in Malaysia. 1 A global guide to business relocation 2015. Labor laws are distinctive between one country to another.

The monthly statutory rate for contribution of foreign employees is 11 of their wage whilst for an Employer is only required to give RM5 per person. The Code for Social Security 2020. Multiply this number by the total days of unpaid leave.

An estimated 50 of Irans GDP was exempt from taxes in FY 2004. Employment is one of the basic necessities of a person to earn money and make a living. For those employers who do pay a 13th-month bonus it is typically paid at the end of the year.

You have the option to determine the value in the work wages. Navigate market uncertainty with validated always-on compensation data from multiple sources delivered transparently through our trusted data platform. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees.

The International Labour Organization estimated in 2019 that there were 169 million international migrants worldwide. The minimum eligible monthly salary can be as low as RM30 the contribution is RM010 monthly. Gaslighting manipulation and grift.

1 month ago Reply to Emily Kuhnert. If the employee has completed less than four weeks service the same basis for calculation can be relied on for a preceding period of one two or three weeks. Click Calculate the button on the bottom part.

The calculation is made by identifying the total number of hours the employee has actually worked over the preceding four weeks and dividing the result by four. Find the number of working days in the current month. Screengrab of MADLSA Qatars online calculator for end of service gratuity End of service gratuity according to Labor Law.

2 Contents 01 Introduction 02 Relocation options 10 Key country summary 12 Key country profiles Americas 13 Argentina 17 Brazil 21 Canada 24 Chile 27 Colombia 30 Mexico 33 Panama 36 Puerto Rico 40 United States 43 Key country profiles Asia Pacific 44 Australia 48 China 52 Hong Kong 56 India 60 New Zealand 63 Singapore 67 Key. According to Social Insurance Law during the sick leave an employee is entitled to hisher salary. Monthly Salary RM2600.

7000- for calculation of bonus and it is the duty of the employer to pay minimum bonus to their employees. The average monthly salary in Shanghai is now RMB 7172. Or b in any other case shall be deemed to be salary or wages income taxable at the rate declared by Section 13 of the Income Tax Salary or Wages Tax Rates Act 1979.

Working Hours per Day 8 hours. 1st June 1957 PART I - PRELIMINARY. An Act relating to employment.

This is a guide to Chinese labor law for multinationals. Access Google Sheets with a personal Google account or Google Workspace account for business use. Labour MPs shouted we must Support the troops our boys and girls in uniform once they had crossed the border irrespective of the known lies.

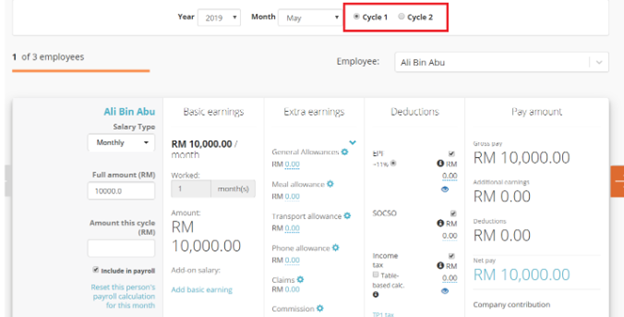

Everything You Need To Know About Running Payroll In Malaysia

.png)

All About Basic Salary Wage In Malaysia

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

How To Sell Online Payslips To Your Employees Payroll Payroll Template National Insurance Number

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Salary Calculation Dna Hr Capital Sdn Bhd

Poland Minimum Gross Hourly Wages And Salaries 2023 Statista

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Formul St Partners Plt Chartered Accountants Malaysia Facebook